On a trip to Lebanon in 2015, I first realized how critical it is for refugees to have access to both aid and economic opportunities. When I opened the curtains of my hotel room in the trendy Hamra district of Beirut, I was struck by the sight of a half-constructed building across the street, most units filled with Syrian refugees looking for shelter ahead of a cold and wet winter in the city.

It was clear that for them, as for most refugees, basic humanitarian assistance such as food and shelter was what they most urgently needed. Yet many other refugees I met in Lebanon during that trip were eager to move beyond humanitarian assistance and were desperately trying to generate livelihoods for themselves and their families.

The international development community as a whole was also coming to a similar conclusion – while emergency humanitarian assistance plays a key role, especially in the early days of a crisis, we must begin thinking about more sustainable solutions for refugees.

Access to finance is one of these solutions, as it empowers refugees to start businesses, pay for urgent medical needs or continue their education. Despite this need, most financial institutions around the world are unwilling to serve refugees, leaving most refugees financially excluded.

Refugees are often perceived as too risky to lend to because they may not have documented credit history, and have few fixed assets or limited collateral. The perceived flight risk, specifically around the uncertain nature of their residency and instability of their living conditions, also contributes to this reluctance.

One of my goals of my 2015 trip to Lebanon was to explore how Kiva, the largest crowdfunding platform for social good, could help. Since 2005, Kiva has facilitated $1.2 billion in lending to entrepreneurs in 85 countries. Our loans are crowdfunded by individuals around the world in increments starting as little as $25. This makes our capital both risk tolerant and compassionate.

In the year following my trip, we launched the World Refugee Fund (WRF) in an effort to mobilize Kiva’s community of lenders to lend to refugees around the world. In addition to individual lenders, the WRF is looking to raise institutional matching funds from the private sector, so that each $25 lent to a refugee on Kiva will be matched 1 to 1, doubling the impact.

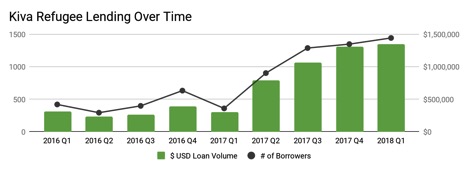

The WRF facilitated more than $1 million in loans in 2016, and $3.5 million in 2017. In 2018, we hope to reach 8,000 displaced people with $7 million in loans. In addition to Syrian refugees in the Middle East, our lending has expanded to internally displaced persons (IDPs) in Colombia, Burundian and Congolese refugees in Rwanda, and we will soon be working with Syrian refugees in Armenia.

Through this work, we have collected compelling evidence which challenges the perception of refugees as “too risky.” We recently released our first Refugee Impact Report, which tracks repayment trends based on over 7,800 refugee borrowers in six countries funded through Kiva since 2016.

Our findings show that refugee and IDP borrowers have a high repayment rate on par with non-refugee borrowers, proving that refugees can, and do, pay back loans. Refugees and IDPs had a 96.6 percent repayment compared to 96.8 percent for non-refugee borrowers on Kiva, illustrating the creditworthiness of refugees. The growth of Kiva’s refugee lending, coupled with high repayment rates, demonstrates that there is a strong business case for financial providers to serve refugees in countries with large refugee populations.

Loans can also help bridge the gap and overcome tensions between refugee populations and host communities. In Lebanon and Jordan, which host large numbers of refugees relative to their overall population, Kiva lenders are funding group loans for Syrian refugees and nationals of the host country. In Lebanon and Jordan, the local financial institutions we work with report that these loans have encouraged personal friendship and economic cooperation between refugees and their Lebanese neighbors.

Today’s discourse often frames refugees as a burden; a population solely in need of aid. And while refugees certainly need the support of the international community, we need to shift the paradigm to one that understands that refugees also have the ability to be significant contributors to local economies and societies as a whole.

I saw how true this is first-hand throughout the time I spent living in Istanbul and traveling to Lebanon and Jordan. And many others documented this in developing countries, such as Rwanda, as well as developed countries, from Denmark to cities in the United States.

It will take a massive effort to see this become a reality for more refugees, one that will require NGOs, the private sector and governments all to play key roles.

Demonstrating that refugees are viable microfinance clients is a crucial first step, but it is only one piece of the puzzle. There are many other challenges to be overcome, including regulatory hurdles, such as governments blocking economic opportunities for refugees. Beyond access to finance and work, refugees need more support and trainings to develop skills and businesses.

Our long-term goal through the World Refugee Fund is to serve as a proof of concept that will help in overcoming these challenges and unlock capital at scale for refugees.

To improve the long-term well-being of refugees, we need to look at the whole picture of what is needed to rebuild their lives and create healthy communities. Our hope is that sharing our experience will encourage other lenders to serve displaced populations.

The views expressed in this article belong to the author and do not necessarily reflect the editorial policy of Refugees Deeply.